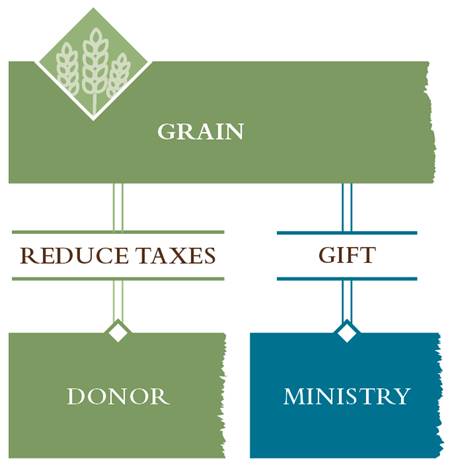

If you are a cash-basis farmer, you may be able to deduct the cost of production of the gifted portion of grain and receive a triple tax savings.

Benefits of a Grain Gift

- Reduce federal income tax

- Reduce state income tax

- Reduce self-employment tax

- Help further the work and mission of Focus on the Family

Tax information

Focus on the Family is a tax-exempt charity under the Internal Revenue Code 501(c)(3).

TAX ID#: 95-3188150

IRS Tax Determination Letter

We strongly suggest that you contact your tax advisor for current tax laws and to determine whether this method of giving is advantageous to your circumstances.